Summary of Trading Ideas For the Upcoming Week Goldman's US Equities Weekly Rundown as of January 24, 2025

Goldman notes flows for Tech, Financials, AI

Here’s a summary of the key trades and flow observations from the US Equities Weekly Rundown as of January 24, 2025:

Thematic Baskets

Top Performers:

Nuclear Basket (GSXURANI): +14.2% WoW, +25.3% YTD.

CCJ 0.00%↑ and a little UUUU 0.00%↑ are where I’m at right now.

AI Infrastructure Baskets (GSTMTDAT & GSENEPOW): Strong momentum driven by policy support and AI growth investments.

AI Software Basket (GSTMTAIS): +5.28% WoW, +7.39% YTD.

Bottom Performers:

Bitcoin-Sensitive Equities (GSCBBTC1): -1.28% WoW.

I am Unreasonably Long MSTR 0.00%↑

Hi-Growth, Hi-Margin Basket (GSPUHGMP): -3.65% WoW.

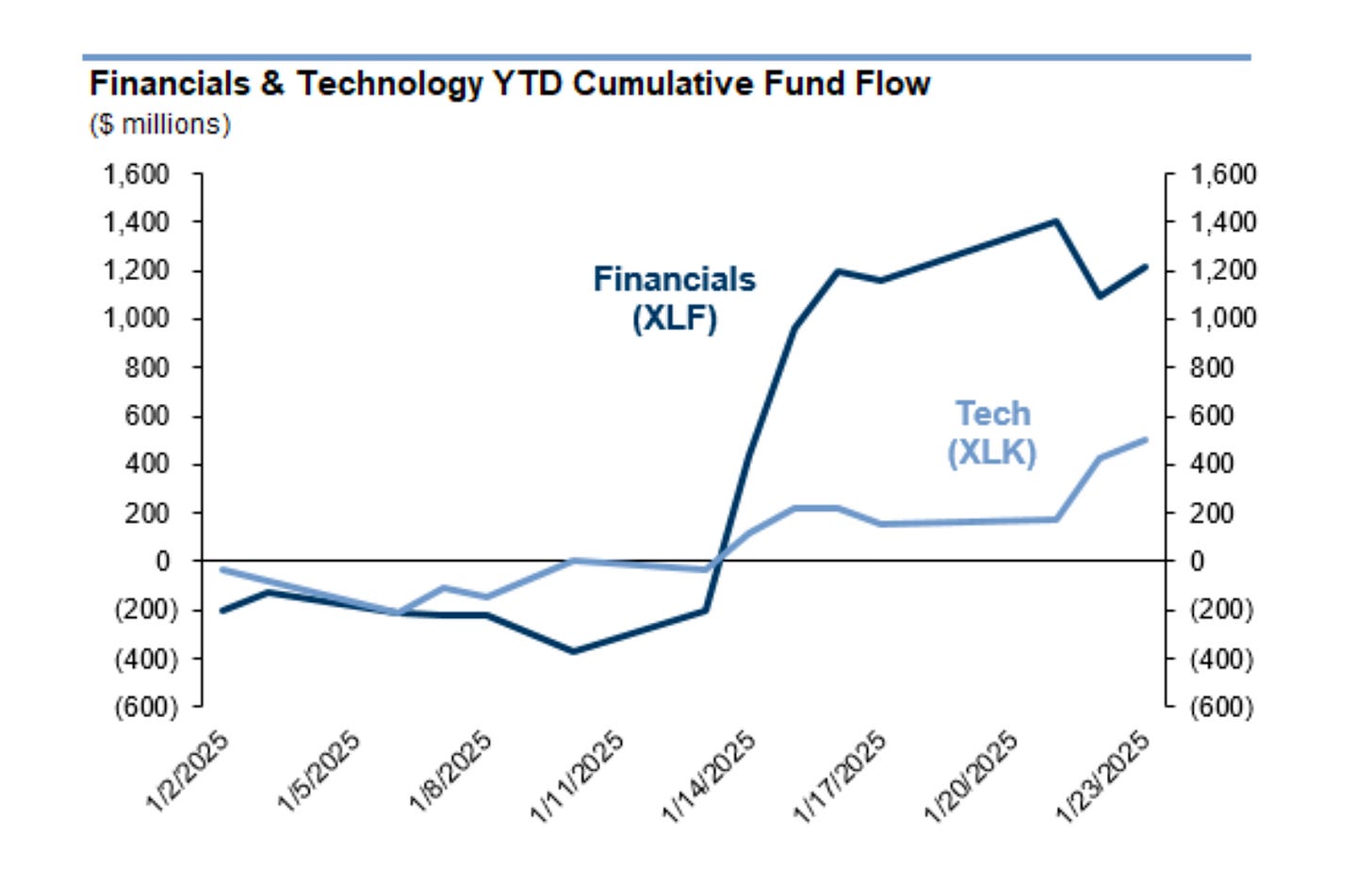

ETF Flows

Tech ETFs: Inflows of $4.9B in January, led by VGT ($1.4B).

Financial ETFs: Inflows of $1.4B, led by XLF ($720M).

Gold ETFs: Outflows of $782M from GLD and IAU as volatility eased post-inauguration.

I added more gold last week. Primarily IAUM 0.00%↑ and I like GDX 0.00%↑ too. Also, SIVR 0.00%↑ and WPM 0.00%↑.

(Source - Goldman Sachs)

Highlighted Trade Ideas

Long AI Infrastructure:

Power Up America Basket (GSENEPOW): Overweights key infrastructure stocks, supported by policy tailwinds.

Last week I added: FIX 0.00%↑ GEV 0.00%↑ MTZ 0.00%↑ and added to UTES 0.00%↑ around the Trump/Softbank/Oracle/OpenAI/Oklo presser.

AI Data Centers Basket (GSTMTDAT): Focused on companies benefiting from AI-driven data center growth.

My picks are DLR 0.00%↑ and EQX 0.00%↑

Financial ETFs:

Benefiting from deregulation expectations under new policy initiatives.

I like XLF 0.00%↑ and KBWB 0.00%↑

Tech Earnings Strategies:

Use delta-neutral topside positions in SPX and NDX to hedge against volatility.

Topside options are typically set slightly out-of-the-money (OTM) to provide cheaper exposure to upside moves. For example:

SPX topside might have strikes like 6,150, 6,200, or 6,250.

NDX topside might have strikes like 21,800, 22,000, or 22,500.

I’m currently long AAPL 0.00%↑ GOOG 0.00%↑ MSFT 0.00%↑ META 0.00%↑ NFLX 0.00%↑ SPOT 0.00%↑

Summary Takeaway

The report highlights strong inflows into AI-related and tech sectors, continued caution around mega-cap tech, and de-grossing in single stocks. Thematic AI infrastructure baskets, supported by policy initiatives, stand out as significant outperformers.

Update:

Goldman published a note, MAG 7 SUPPLY INTO EARNINGS CREATES FAVORABLE SETUP

FICC and Equities | 25 January 2025 | 5:57PM UTC

Their opinion is:

“What to specifically watch for in regards to the big 3 this week: 1) MSFT positioning is cleaner. Major focus on timing of Azure Cloud re-acceleration, commentary on Stargate and updated view on Capex. 2) META there is a fair bit of 'angst' into numbers given an expected above street guide on capex + expenses for 2025 (vs 1Q headwinds from FX, leap day, etc). Big picture, all about path to monetizing AI ambitions across the ~3.3 bn user base. Headlines hit yesterday guiding FY25 Capex to $60-65bn vs. street $51bn (slightly above the street). 3) AAPL: amidst one of its biggest months of under-performance in years, all eyes on March qtr revs guide - where investors debating if a potentially below street revs guide is a clearing event (into 2H cycle) or not. (H/T Peter Callahan)”

BofA’s flows team has a similar view. Here is a summary:

BofA's Systematic Flows Monitor (January 24, 2025)

Key Observations for Traders

CTA Positioning and USD Trends:

CTAs (trend-following strategies) are at risk of continued USD long unwinds as the dollar (DXY) posted its worst start to a presidential term in history.

Long positions in currencies like EUR, GBP, and AUD could be covered further if the USD continues weakening.

Equity Buying Potential:

CTAs are moderately long S&P 500 and Nasdaq-100, and further gradual accumulation is expected as equities rally.

EURO STOXX 50 is likely to see rapid CTA buying, potentially leaving the position overstretched by next week.

Commodities:

Oil: Long positions are approaching stretched levels, even though crude prices have declined for six straight days.

Gold: Moderate long positions are building, with potential for further accumulation.

SPX Gamma Risks:

SPX gamma levels have surged to +$15.2 billion (98th percentile), but this is concentrated in short-dated options expiring soon, creating near-term volatility risks as these options roll off.

Leveraged and Inverse ETFs:

Rebalancing flows from ETFs could amplify index movements near the close. For example:

A 1% move in the S&P 500 would trigger approximately $885M in ETF flow.

For the Nasdaq-100, it would trigger $2.03B in ETF flow.

Highlighted Trade Ideas

Equities:

Buy EURO STOXX 50 Futures: Expected rapid CTA buying could boost the index further.

Nikkei 225 Futures: With a 3.9% gain this week, CTAs may add to longs in Japanese equities.

Currencies:

Short USD Against EUR, GBP, AUD: Continued USD weakness presents an opportunity as CTAs unwind long positions.

Commodities:

Gold: Increase exposure to gold as long positions build amid rising demand.

Crude Oil: Watch for near-term overbought signals, but long positions remain favorable given supportive CTA trends.

Options Strategy:

SPX Delta-Neutral Strategies: Hedge against gamma-driven volatility with delta-neutral or short-dated call spreads to capitalize on potential equity moves.

Summary Takeaway

The report underscores a bullish bias for global equities, particularly in Europe and Japan, and highlights opportunities to position for continued USD weakness. Traders should also be mindful of near-term SPX volatilitydriven by gamma positioning.