Unlocking Market Insights: Hartnett's Latest 'Flow Show' Newsletter (Jan 30, 2025) Trading Plan"

Exploring the Key Takeaways from Hartnett's Fresh Insights and How They Shape Strategic Market Moves

As you know by now, I’m a little bit of a Michael Hartnett fanboy. I’m not making all these trades but I’m always interested in his weekly report. Here’s a summary of Friday’s.

📌 2025 Playbook

✅ Reduce: Mega-cap tech (QQQ, growth-heavy ETFs).

✅ Overweight: Equal-weight S&P 500 (RSP), Small-caps (IWM), Value (VLUE).

✅ Rotate into: Cyclicals (XLI, XLB, XLY), Financials (XLF), Emerging Markets (EEM).

✅ Hedge: Short QQQ or overweight commodities as inflation hedge.

Strategy Overview

The report highlights key macroeconomic themes:

Peaking US Exceptionalism: US economic growth driven by excessive fiscal spending, immigration, and AI capex is slowing.

Monetary Easing Peaking: Central banks have significantly cut rates, but the pace of cuts is slowing.

Trough in Manufacturing PMI: Expected recovery in global manufacturing, favoring commodities, high-yield bonds, and international equities.

Asset Allocation & Timing

1. Equities

Long Japan & European Banks (Q1-Q2 2025)

Rationale: These sectors remain undervalued (Japan banks -74% since 1989, EU banks -67% since 2007), and monetary/fiscal stimulus in Europe and China is expected.

Entry: Watch for pullbacks triggered by US tariff discussions.

Exit: Q3-Q4 2025 or when valuations approach historical norms.

Short US Tech (Selective "Magnificent 7") (Q2-Q4 2025)

Rationale: US market dominance peaking; AI hype overvalued; hedge against rising inflation risk. BofA’s Peaking US Exceptionalism thesis suggests that the factors driving the outsized US market outperformance(fiscal spending, immigration, AI capex) are fading. This implies a shift away from US mega-cap growth and a potential broadening of market leadership.

Entry: After any major AI-related earnings pump.

Exit: When US monetary policy shifts back to easing.

🔻 Reduce Exposure to:

Mega-Cap Tech (QQQ / Nasdaq / “Magnificent 7”)

AI spending hype is peaking (DeepSeek AI capex wave maturing).

Overcrowded trade—investors are all-in on US exceptionalism, which suggests vulnerability.

Potential Trade: Rotate out of QQQ into broader market or value-oriented plays.

🔼 Increase Exposure to:

Equal-Weight S&P 500 (RSP) vs. Market-Cap Weighted (SPY)

If US exceptionalism fades, breadth should increase as smaller companies catch up.

Equal-weight reduces dependency on mega-cap tech, benefiting from sector rotation.

Potential Trade: Long RSP / Short SPY as a mean-reversion play.

Small-Caps (IWM – Russell 2000)

Small caps outperform in early-cycle recoveries, especially with lower rates.

If Fed cuts in 2H 2025, small caps benefit from cheaper borrowing costs.

Potential Trade: Long IWM (Russell 2000) vs. SPY.

Value & Cyclicals Over Growth (VLUE vs. QQQ)

Growth stocks have dominated, but value historically outperforms in inflationary regimes.

If AI-driven spending slows, old economy sectors (industrials, financials, materials) benefit.

Potential Trade: Long VLUE (MSCI USA Value ETF) / Short QQQ.

Risk Management & Trade Timing

Early 2025: Watch for Fed rate policy signals—if the Fed slows cuts, cyclicals might stall.

Mid-2025: If manufacturing PMI recovers, cyclicals, small caps, and value outperform.

H2 2025: If the Fed cuts rates aggressively, small caps & financials get a second wind.

Long Emerging Markets (China Consumer & Tech) (Q1-Q3 2025)

Rationale: China is boosting domestic consumption; geopolitical stabilization benefits EM.

Entry: Upon US dollar (DXY) breaking below 105.

Exit: If US dollar strengthens above 108 or China policy shifts unexpectedly.

🔼 Buy: Emerging Markets (EEM, FXI)

US growth premium is shrinking, and capital may rotate into undervalued international markets.

China consumer & tech, Japan & EU banks are BofA’s favored global plays.

Potential Trade: Long EEM (Emerging Markets) or FXI (China Large-Cap) if DXY < 105.

2. Fixed Income

Long High-Yield (HY) Bonds & Emerging Market Debt (Q1-Q2 2025)

Rationale: HY bonds had their largest inflows in 3 months, signaling investor demand.

Entry: Use any spread widening as an opportunity.

Exit: If credit spreads start tightening aggressively.

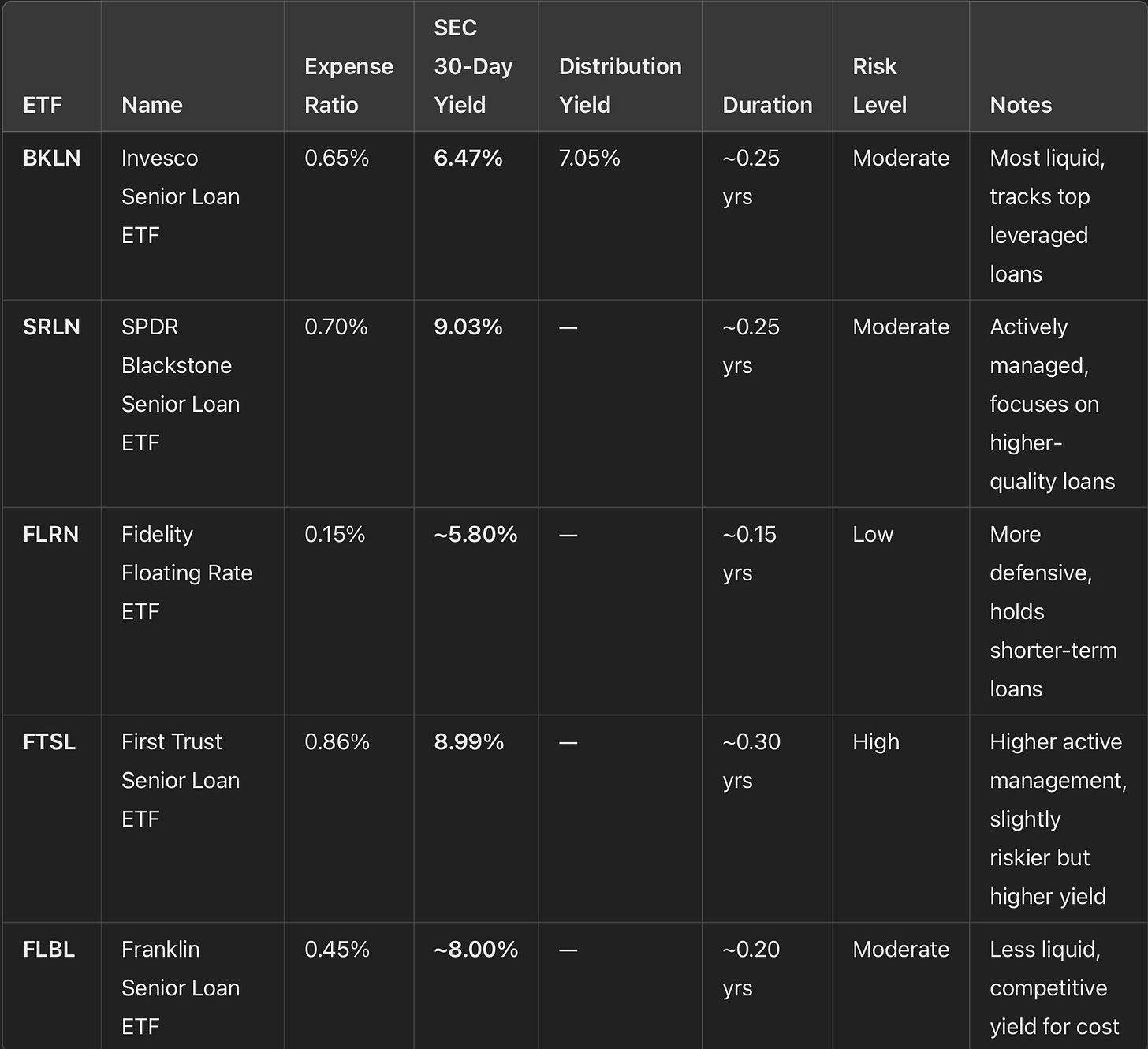

Golden Black: In the past I held XCCC 0.00%↑, SPHY 0.00%↑, and FLBL 0.00%↑. BKLN 0.00%↑ is lower risk and more liquid. I’m going to look at these again.

Risks & When to Exit

⚠️ If Fed Cuts Rates Faster Than Expected

Bank loans perform better when rates stay high. If the Fed accelerates cuts, yields on these loans will drop.

⚠️ Credit Risk & Defaults

Senior loans are below investment grade, meaning they have higher default risk if the economy weakens.

If corporate earnings decline, expect higher delinquencies in 2025.

Summary of a selection of Sr Loan products:

Quick Takeaways:

BKLN → Best for liquidity & passive exposure to senior loans.

SRLN → Best yield (~9%), higher-quality loans, but actively managed.

FLRN → Lowest cost (0.15%), most defensive, shorter-duration loans.

FTSL → High active mgmt, strong yield, but higher risk.

FLBL → Less liquid but solid mid-cost option.

3. Commodities & FX

Long Commodities (Gold, Silver, Industrial Metals, Oil) (Q1-Q3 2025)

Rationale: Manufacturing recovery supports materials; gold acts as an inflation hedge.

Entry: Buy on dips when US rate cut expectations are revised downward. Gold is currently at all time highs.

Exit: If global inflation unexpectedly declines.

Short US Dollar (DXY) (Q2-Q3 2025)

Rationale: Dollar weakness expected as US exceptionalism fades.

Entry: When Fed signals a shift toward more aggressive rate cuts.

Exit: If inflation forces the Fed to delay cuts.

Risk Management

Do it. I prefer scaling size of positions, others like stop loss trades. Yet others hedge. Just do something.

Adjust exposure if macro signals change (e.g., unexpected Fed tightening).

Monitor geopolitical risks impacting China, EU, and EM assets.